How To Use The Nova IQ Backtester

The Nova IQ backtester is your personal tool to prove that Nova IQ works.

With the Nova IQ backtester you can backtest any asset/timeframe combination, and even create your own Nova IQ strategy to set alerts for!

Note

While Nova IQ will always trade optimally, using the Nova IQ backtester allows you to replicate Nova IQ's performance while skipping all the chart visualizations. Traders can deep dive into statistics with the backtester, export Nova IQ trades to an excel file, set alerts, and much more!

How To Use The Nova IQ Backtester

As complex as Nova IQ's underlying processes are, the backtester is incredibly simple to use.

Step 1: Go to the asset/timeframe you wish to test.

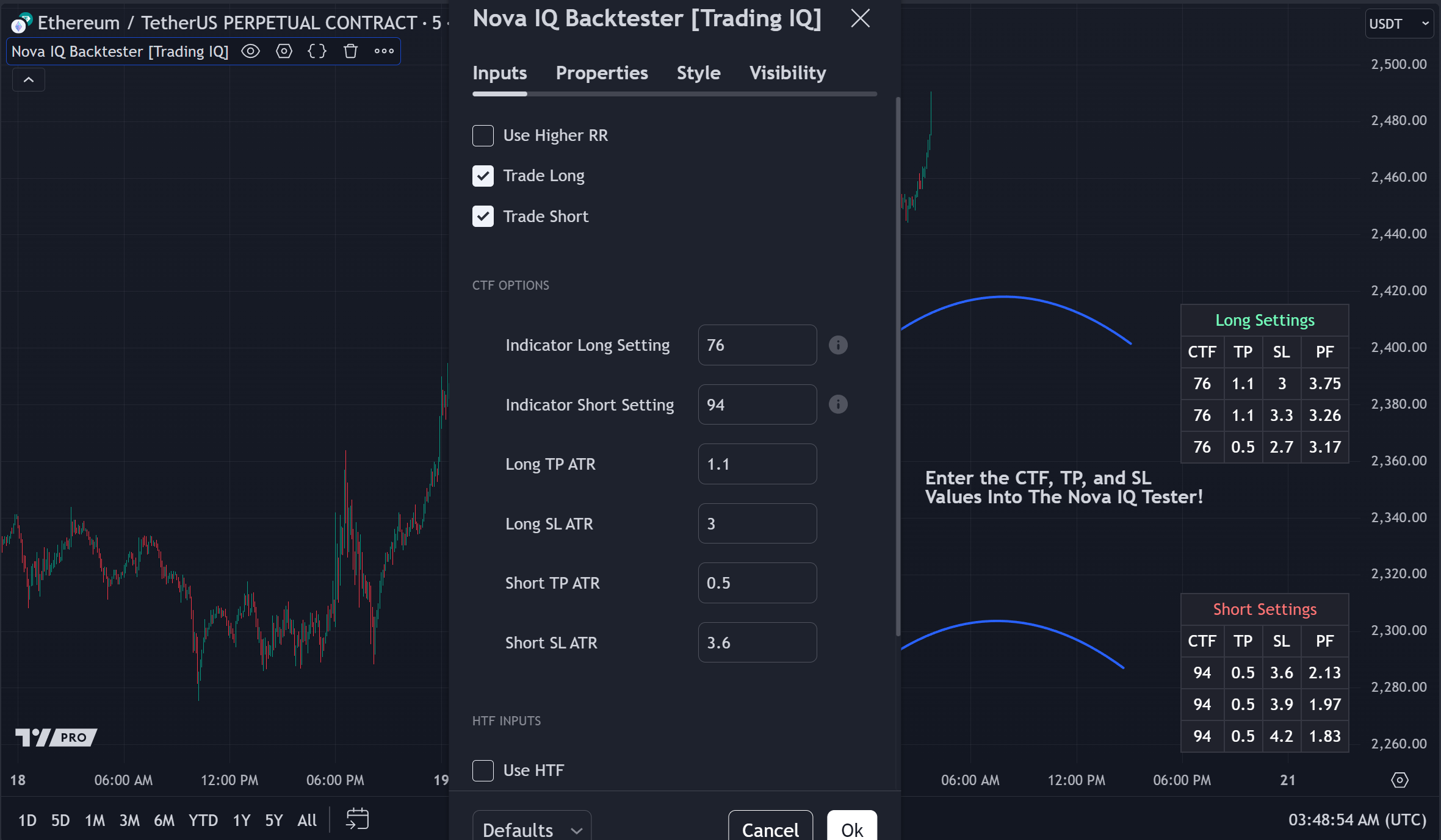

For this example we will use the 5-minute chart for ETHUSDT.P!

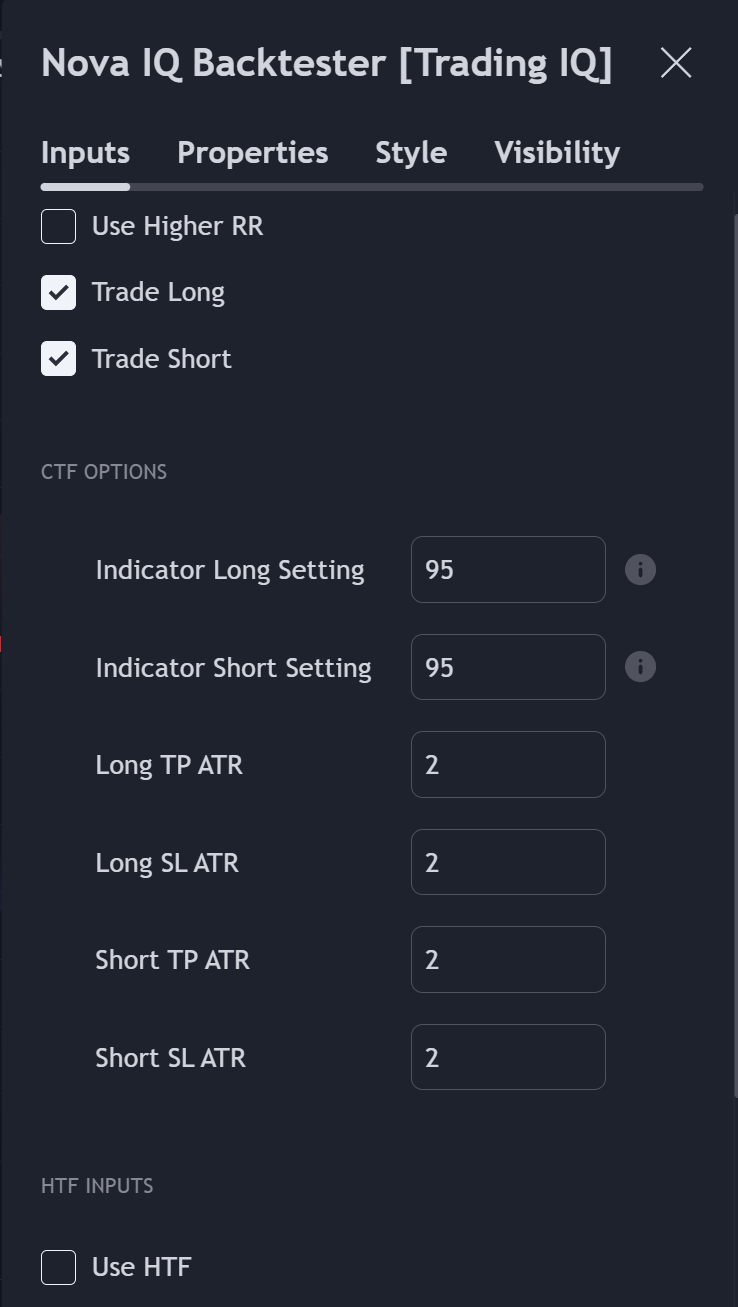

Step 2: Choose Nova IQ's Use HTF Option and trade direction.

For this example, Use HTF will be deselected and both long and short positions will be traded!

Step 3: Enter the optimized parameters

There's quite a bit going on here so let's cover it extensively!

In this image, the Nova IQ backtester has finished finding optimized settings for entries and exits. The right tables show the optimal settings for the long strategy of Nova IQ and for the short strategy of Nova IQ.

The Nova IQ backtester has six adjustable settings for longs and shorts when Use HTF is not selected. When Use HTF is selected the backtester has nine adjustable settings!

- Indicator Long Setting

- Long TP ATR

- Long SL ATR

Short settings include:

- Indicator Short Setting

- Short TP ATR

- Short SL ATR

The optimal Indicator Long setting is shown in the middle-right table. That value is "76". As shown in the image, we entered "76" into the Indicator Long setting for the Nova IQ backtester. Additionally, the optimal TP/SL for the Nova IQ long strategy are "1.1" for TP and "3" for SL, which we entered into the "Long TP ATR" and "Long SL ATR" settings.

The optimal Indicator Short setting is shown in the bottom-right table. That value is "94". As shown in the image, we entered "94" into the Indicator Short setting for the Nova IQ backtester. Additionally, the optimal TP/SL for the Nova IQ short strategy are "0.5" for TP and "3.6" for SL, which we entered into the "Short TP ATR" and "Short SL ATR" settings.

Note

The "PF" column of the table indicates the optimized settings scored profit factor. The higher this number is - the better!

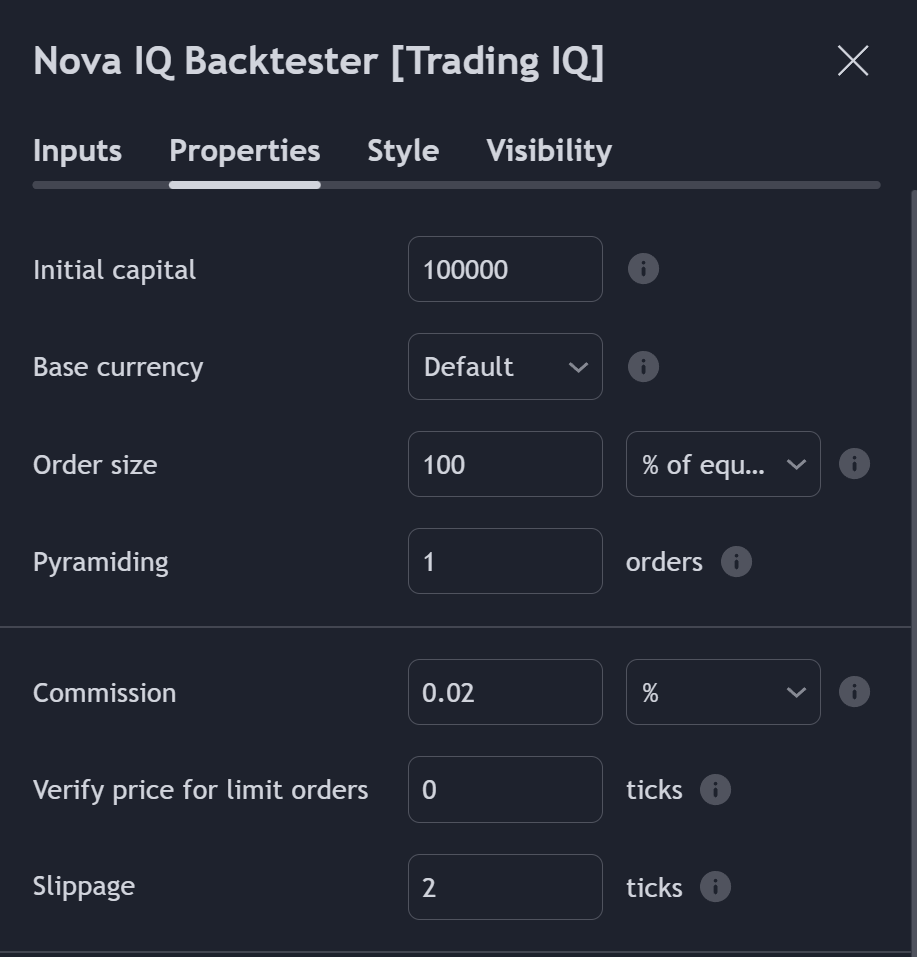

Step 4: Enter Commissions and Slippage

Go to the "Properties" table in the Nova IQ Settings and change contract size, initial balance, commission, slippage, etc.

For this example, we're using a fee of 0.02%, 2 ticks slippage, $1000 starting balance. You can experiment with compounding and other portfolio tricks in this table!

Step 5: Evaluate Backtest Performance

Voila! We successfully verified the performance of Nova IQ in just a few minutes.

You can repeat this process for any asset on any timeframe.