US Futures Overview

Wick Slicer IQ works, and you can prove it yourself.

Tip

For quick verification of Wick Slicer IQ's performance, just take a look at the top-right table showing the profit factor for longs and the bottom-right table showing the profit factor for shorts.

It's easy to set universal portfolio management settings for cryptocurrencies, since you can purchase fractions of the underlying crypto. However, portfolio management settings for U.S Futures can get a little more tricky. You can't purchase fractional contracts and, to scale/compound your money, you'll need to purchase more contracts. Sounds easy enough; however, the catch is that a single contract is usually quite expensive. The difference in profit potential between 1 or 2 contracts can be quite large!

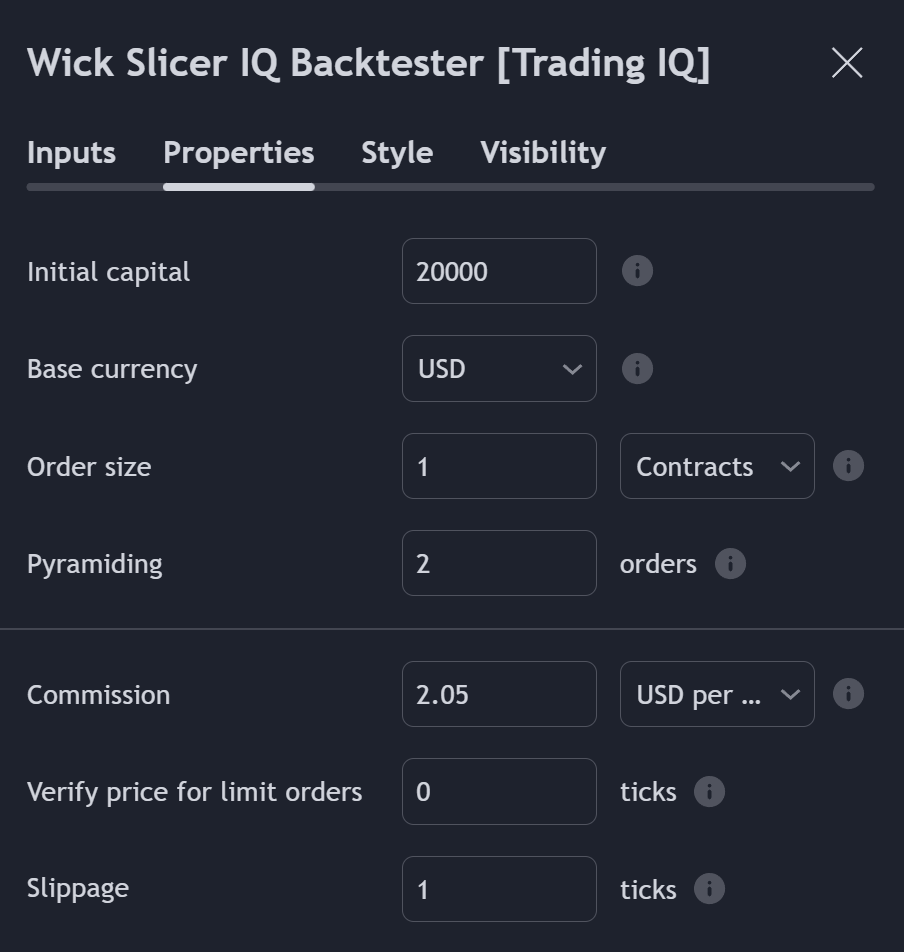

In your personal testing you can experiment with the number of contracts to purchase as much as you want. To keep all backesting in this portion of the docs simple and intuitive, we'll only purchase 1 contract per trade. This means no compounding!

Futures trading is rife with fees. Thankfully, fees across brokerages are quite competitive. For all U.S mini-contracts we'll be using $2.05 fee per order with 1 tick slippage.

Settings

Additionally, all US Futures backtests will use a starting balance of $20,000 USD.

Note

You have complete control over verifying the accuracy of Wick Slicer IQ. You can change the commission value to the real commissions you pay, increase slippage, and more.

Tip

When looking at backtest data, the dollar-amount profit and dollar-amount drawdown are less important than other metrics, as the raw-dollar amount profit and raw-dollar amount drawdown are highly specific to the trader's balance. Instead, it's more important to evaluate percentage metrics and ratio metrics, such as the profit percentage, profit factor, and drawdown percentage - these metrics are relatively consistent across various balances. Additionally, risk-performance metrics such as the Sharpe Ratio are good indications of a strategy's viability.

Note

All of our backtests will show a green line. The green line is the performance of Wick Slicer IQ. Some of our backtests will include a blue line. The blue line is the buy-and-hold performance of the asset. What's important here is that the green equity curve (Wick Slicer IQ) outperforms the blue equity curve (asset). If it does, this means Wick Slicer IQ is more profitable than simply buying the asset and holding it!